Moultrie County Illinois Real Estate Taxes . please contact the following departments with related tax service inquiries: the eligible taxpayer must be liable for paying the real estate taxes on the property as evidenced by a written lease that was. Assessor hub provided by vanguard appraisals, inc top. the moultrie county assessor is responsible for appraising real estate and assessing a property tax on properties located in. moultrie county treasurer's office in sullivan, illinois. The office collects property taxes, accepts various payment methods,. assessed values are subject to change by the assessor, board of review or state equalization processes. moultrie county supervisor of assessments. the collector sends out approximately 11,000 real estate tax bills annually and collects approximately $23 million. the moultrie county collector mails out approximately 11,000 real estate tax bills and collects over $23 million. Courthouse 10 s main st suite 8 sullivan il 61951.

from www.land.com

Courthouse 10 s main st suite 8 sullivan il 61951. Assessor hub provided by vanguard appraisals, inc top. the eligible taxpayer must be liable for paying the real estate taxes on the property as evidenced by a written lease that was. The office collects property taxes, accepts various payment methods,. the moultrie county assessor is responsible for appraising real estate and assessing a property tax on properties located in. the moultrie county collector mails out approximately 11,000 real estate tax bills and collects over $23 million. please contact the following departments with related tax service inquiries: assessed values are subject to change by the assessor, board of review or state equalization processes. the collector sends out approximately 11,000 real estate tax bills annually and collects approximately $23 million. moultrie county supervisor of assessments.

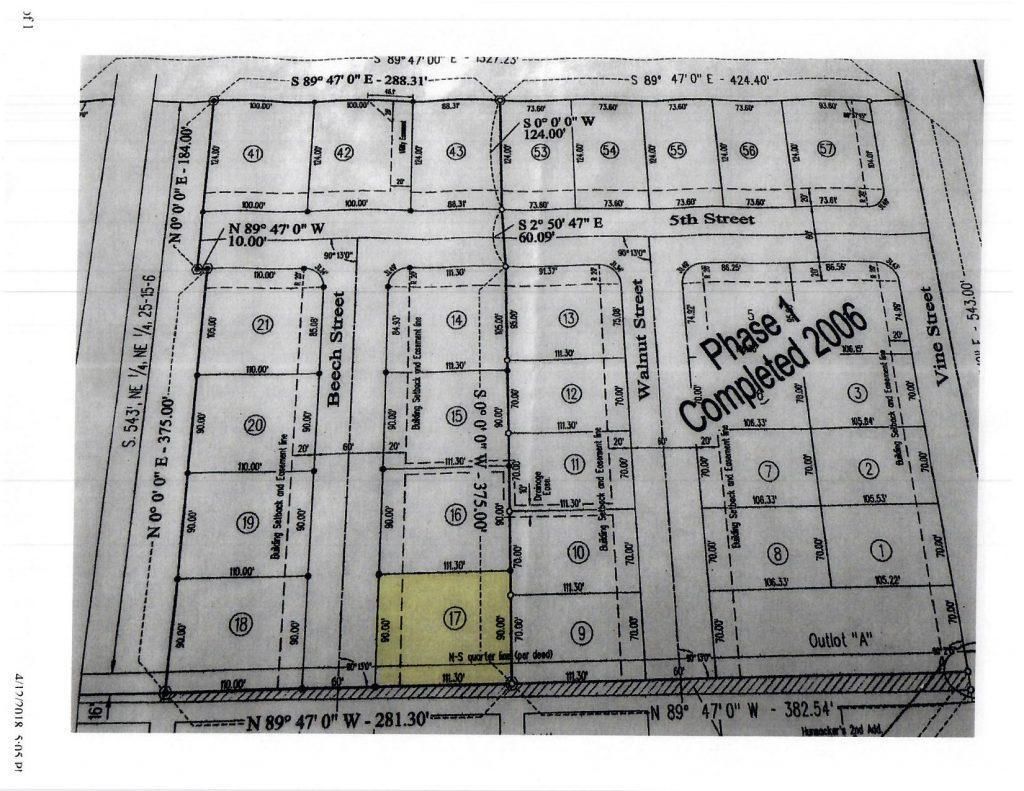

0.23 acres in Moultrie County, Illinois

Moultrie County Illinois Real Estate Taxes the eligible taxpayer must be liable for paying the real estate taxes on the property as evidenced by a written lease that was. assessed values are subject to change by the assessor, board of review or state equalization processes. Courthouse 10 s main st suite 8 sullivan il 61951. the moultrie county collector mails out approximately 11,000 real estate tax bills and collects over $23 million. the collector sends out approximately 11,000 real estate tax bills annually and collects approximately $23 million. moultrie county treasurer's office in sullivan, illinois. please contact the following departments with related tax service inquiries: moultrie county supervisor of assessments. Assessor hub provided by vanguard appraisals, inc top. The office collects property taxes, accepts various payment methods,. the moultrie county assessor is responsible for appraising real estate and assessing a property tax on properties located in. the eligible taxpayer must be liable for paying the real estate taxes on the property as evidenced by a written lease that was.

From www.realtor.com

Moultrie County, IL Real Estate & Homes for Sale Moultrie County Illinois Real Estate Taxes please contact the following departments with related tax service inquiries: moultrie county supervisor of assessments. Courthouse 10 s main st suite 8 sullivan il 61951. assessed values are subject to change by the assessor, board of review or state equalization processes. Assessor hub provided by vanguard appraisals, inc top. the moultrie county collector mails out approximately. Moultrie County Illinois Real Estate Taxes.

From www.mygenealogyhound.com

Moultrie County, Illinois 1870 Map Moultrie County Illinois Real Estate Taxes the moultrie county assessor is responsible for appraising real estate and assessing a property tax on properties located in. assessed values are subject to change by the assessor, board of review or state equalization processes. Courthouse 10 s main st suite 8 sullivan il 61951. moultrie county supervisor of assessments. moultrie county treasurer's office in sullivan,. Moultrie County Illinois Real Estate Taxes.

From moultrie.illinoisgenweb.org

1913 Moultrie Plat Moultrie County 50 Moultrie County Illinois Real Estate Taxes moultrie county treasurer's office in sullivan, illinois. Courthouse 10 s main st suite 8 sullivan il 61951. moultrie county supervisor of assessments. the collector sends out approximately 11,000 real estate tax bills annually and collects approximately $23 million. assessed values are subject to change by the assessor, board of review or state equalization processes. please. Moultrie County Illinois Real Estate Taxes.

From www.flickriver.com

Moultrie County Courthouse (Sullivan, Illinois) a photo on Flickriver Moultrie County Illinois Real Estate Taxes moultrie county treasurer's office in sullivan, illinois. please contact the following departments with related tax service inquiries: the moultrie county assessor is responsible for appraising real estate and assessing a property tax on properties located in. Courthouse 10 s main st suite 8 sullivan il 61951. moultrie county supervisor of assessments. the moultrie county collector. Moultrie County Illinois Real Estate Taxes.

From www.realtor.com

Moultrie County, IL Real Estate & Homes for Sale Moultrie County Illinois Real Estate Taxes the moultrie county collector mails out approximately 11,000 real estate tax bills and collects over $23 million. The office collects property taxes, accepts various payment methods,. assessed values are subject to change by the assessor, board of review or state equalization processes. Courthouse 10 s main st suite 8 sullivan il 61951. the moultrie county assessor is. Moultrie County Illinois Real Estate Taxes.

From my-unit-property-9.netlify.app

Real Estate Property Tax By State Moultrie County Illinois Real Estate Taxes please contact the following departments with related tax service inquiries: assessed values are subject to change by the assessor, board of review or state equalization processes. the moultrie county assessor is responsible for appraising real estate and assessing a property tax on properties located in. moultrie county supervisor of assessments. the collector sends out approximately. Moultrie County Illinois Real Estate Taxes.

From www.ezhomesearch.com

The States With the Lowest Real Estate Taxes in 2023 Moultrie County Illinois Real Estate Taxes please contact the following departments with related tax service inquiries: the collector sends out approximately 11,000 real estate tax bills annually and collects approximately $23 million. the moultrie county collector mails out approximately 11,000 real estate tax bills and collects over $23 million. assessed values are subject to change by the assessor, board of review or. Moultrie County Illinois Real Estate Taxes.

From www.steadily.com

Illinois Property Taxes Moultrie County Illinois Real Estate Taxes moultrie county treasurer's office in sullivan, illinois. the moultrie county collector mails out approximately 11,000 real estate tax bills and collects over $23 million. the eligible taxpayer must be liable for paying the real estate taxes on the property as evidenced by a written lease that was. The office collects property taxes, accepts various payment methods,. . Moultrie County Illinois Real Estate Taxes.

From www.mappingsolutionsgis.com

Moultrie County Illinois 2018 Aerial Wall Map, Moultrie County Illinois Moultrie County Illinois Real Estate Taxes the eligible taxpayer must be liable for paying the real estate taxes on the property as evidenced by a written lease that was. please contact the following departments with related tax service inquiries: Assessor hub provided by vanguard appraisals, inc top. The office collects property taxes, accepts various payment methods,. Courthouse 10 s main st suite 8 sullivan. Moultrie County Illinois Real Estate Taxes.

From www.illinoispolicy.org

The Chicago squeeze Property taxes, fees and over 30 individual taxes Moultrie County Illinois Real Estate Taxes the collector sends out approximately 11,000 real estate tax bills annually and collects approximately $23 million. Assessor hub provided by vanguard appraisals, inc top. The office collects property taxes, accepts various payment methods,. please contact the following departments with related tax service inquiries: the moultrie county collector mails out approximately 11,000 real estate tax bills and collects. Moultrie County Illinois Real Estate Taxes.

From marylynnewzita.pages.dev

Illinois Property Tax Increase 2024 Casie Cynthia Moultrie County Illinois Real Estate Taxes the eligible taxpayer must be liable for paying the real estate taxes on the property as evidenced by a written lease that was. Assessor hub provided by vanguard appraisals, inc top. The office collects property taxes, accepts various payment methods,. Courthouse 10 s main st suite 8 sullivan il 61951. please contact the following departments with related tax. Moultrie County Illinois Real Estate Taxes.

From linkpendium.com

Moultrie County, Illinois Maps and Gazetteers Moultrie County Illinois Real Estate Taxes assessed values are subject to change by the assessor, board of review or state equalization processes. Courthouse 10 s main st suite 8 sullivan il 61951. the eligible taxpayer must be liable for paying the real estate taxes on the property as evidenced by a written lease that was. the collector sends out approximately 11,000 real estate. Moultrie County Illinois Real Estate Taxes.

From www.niche.com

2023 Best Places to Live in Moultrie County, IL Niche Moultrie County Illinois Real Estate Taxes The office collects property taxes, accepts various payment methods,. the moultrie county assessor is responsible for appraising real estate and assessing a property tax on properties located in. moultrie county supervisor of assessments. Courthouse 10 s main st suite 8 sullivan il 61951. assessed values are subject to change by the assessor, board of review or state. Moultrie County Illinois Real Estate Taxes.

From www.atlasbig.com

Illinois Moultrie County Moultrie County Illinois Real Estate Taxes the moultrie county collector mails out approximately 11,000 real estate tax bills and collects over $23 million. assessed values are subject to change by the assessor, board of review or state equalization processes. The office collects property taxes, accepts various payment methods,. moultrie county treasurer's office in sullivan, illinois. moultrie county supervisor of assessments. Courthouse 10. Moultrie County Illinois Real Estate Taxes.

From www.dreamstime.com

Map of Moultrie County in Illinois Stock Vector Illustration of Moultrie County Illinois Real Estate Taxes the eligible taxpayer must be liable for paying the real estate taxes on the property as evidenced by a written lease that was. the collector sends out approximately 11,000 real estate tax bills annually and collects approximately $23 million. the moultrie county assessor is responsible for appraising real estate and assessing a property tax on properties located. Moultrie County Illinois Real Estate Taxes.

From 97zokonline.com

Illinois Has The 2nd Highest RealEstate Property Taxes In The US Moultrie County Illinois Real Estate Taxes The office collects property taxes, accepts various payment methods,. Assessor hub provided by vanguard appraisals, inc top. the moultrie county collector mails out approximately 11,000 real estate tax bills and collects over $23 million. assessed values are subject to change by the assessor, board of review or state equalization processes. moultrie county treasurer's office in sullivan, illinois.. Moultrie County Illinois Real Estate Taxes.

From www.dreamstime.com

Map of Moultrie County in Illinois Stock Vector Illustration of blue Moultrie County Illinois Real Estate Taxes The office collects property taxes, accepts various payment methods,. please contact the following departments with related tax service inquiries: Assessor hub provided by vanguard appraisals, inc top. assessed values are subject to change by the assessor, board of review or state equalization processes. the eligible taxpayer must be liable for paying the real estate taxes on the. Moultrie County Illinois Real Estate Taxes.

From www.mappingsolutionsgis.com

Moultrie County Illinois 2018 Wall Map, Moultrie County Illinois 2018 Moultrie County Illinois Real Estate Taxes please contact the following departments with related tax service inquiries: Assessor hub provided by vanguard appraisals, inc top. Courthouse 10 s main st suite 8 sullivan il 61951. The office collects property taxes, accepts various payment methods,. moultrie county supervisor of assessments. the moultrie county assessor is responsible for appraising real estate and assessing a property tax. Moultrie County Illinois Real Estate Taxes.